Alerted by a tweet by him, I recently listened to a December 2020 C-SPAN talk, on “Paper Money in Antebellum America,” by historian Joshua Greenberg, the author of Bank Notes and Shinplasters: The Rage for Paper Money in the Early Republic.

Alerted by a tweet by him, I recently listened to a December 2020 C-SPAN talk, on “Paper Money in Antebellum America,” by historian Joshua Greenberg, the author of Bank Notes and Shinplasters: The Rage for Paper Money in the Early Republic.

I haven’t yet read his book. But Greenberg’s talk is worth a listen. I was especially intrigued by his suggestion that, because they had to deal with so many different banknotes, including many of doubtful value, early Americans acquired a degree of financial savviness they sorely lack nowadays. Greenberg’s related thesis that, by virtue of their very lack of uniformity, antebellum banknotes conveyed a lot of useful information about the locations and conditions of banks that issued them, sounds downright Hayekian. “Ultimately,” he says,

Americans lost an important source of knowledge about banking and the mechanics of the economy, when they no longer had to scrutinize every bill that came into their hands.

Unfortunately, Greenberg also labors under several misconceptions, most of which are all too common among non-economic historians of his subject. (Another example is my friend and former UGA colleague Stephan Mihm, whose 2009 HUP book, A Nation of Counterfeiters, recognizes economic historians’ pertinent writings in a portmanteau footnote, only to ignore many of their findings in its main text.) Besides the seemingly ineradicable howler (more often suggested than stated outright) that unscrupulous bankers were more common than honest ones, these misconceptions mainly concern (1) the fundamental cause of antebellum banknote discounts; (2) the extent of the problem on the eve of the Civil War, and the part it played in the monetary legislation that took place then; (3) the means by which that legislation achieved a uniform currency; and (4) whether the public really benefited from this reform. Greenberg also dramatically overstates the role banknote designs played in building confidence in various currency brands.

I’ll now address each of these points.

An Elephant in the Room

Between the demise of the Second Bank of the United States and the Civil War, U.S. paper currency consisted entirely of notes issued by hundreds of state-chartered commercial banks: there were already between six and seven hundred state banks at the start of the period, and by the outbreak of the Civil War there were more than twice that number. As if that weren’t bewildering enough, instead of always commanding their face value in gold or silver coin, banknotes often commanded less, depending on how far they’d traveled from their source, and on whether that source was known to be a reputable and still-going concern or not.

In his talk Greenberg does a fine job relating these notorious facts. But he falls short when it comes to explaining why things were so. One infers, from various statements he makes, that he attributes the non-uniformity of antebellum banknotes to the fact that they were issued by distinct banks that weren’t subject to any common, federal regulation, and to the fact that these notes weren’t legal tender.

But it’s easy to show that these facts alone can’t account for such a plethora of differently valued notes. Many other countries managed to achieve uniform currencies, despite having numerous banks of issue, the notes of which were also not legal tender. To this day Scottish banknotes aren’t legal tender; nor, for that matter, are Bank of England notes. Yet Scotland’s banknote currency was uniform throughout the U.S. antebellum era, when it had dozens of only very lightly regulated banks of issue: although the Bank Notes (Scotland) Act of 1845 required 100 percent Bank of England note or specie backing for all Scottish banknotes beyond a fixed fiduciary limit, this requirement only became binding some years later.

The case of Canada is still more pertinent, owing to its similar geographic size. Despite having had a much smaller population, with many sparsely populated regions and many fewer miles of railroads than the U.S. at the time, Canada had achieved a uniform banknote currency by the mid-1890s. Yet its banks all held distinct assets, and their notes weren’t legal tender. Had Canada been as populous in 1860 as the U.S., with as many miles of railroad, then assuming the same banks and regulations as in 1890, it’s quite likely that it would have achieved a uniform currency by then. (For more details turn here.)

What accounts for the difference between the U.S. and Canada? The answer is the elephant that’s in the room throughout Greenberg’s talk: “unit banking.” A unit bank is a bank that operates out of a single location only, instead of having branches. Until several decades ago, most U.S. banks were still unit banks; and back before the Civil War almost all were unable to have branches, even locally. In contrast, even in the 19th century most Canadian banks had branch networks, typically stretching from one end of the country to the other.

Why did that matter? Whereas with unit banking a banknote could only be redeemed at one place, with branch banking a bank’s notes could be redeemed at any of its branches. Put another way, under branch banking, the discount applied to a note’s face value was a function of the distance it had traveled from the issuing bank’s nearest branch only. Because, as Greenberg recognizes, distance from redemption points was the main factor driving antebellum U.S. banknote discounts, antebellum barriers to branch banking were more to blame for those discounts than any lack of federal oversight or the fact that antebellum banknotes weren’t legal tender.

Pennies on the Dollar

It’s also true, however—as Greenberg also recognizes—that, besides reflecting the distance banknotes had traveled from their sources, note discounts could also reflect “a perceived fear” that notes would not be “redeemed properly for gold or silver coins if they were brought back to the bank that issued them.” But the typically large discounts placed on such doubtful notes, like those placed on notes of banks known to have failed, put them in a quite different category from others. As Jane Knodell points out, whereas trusted notes were “bankable” despite being subject to discounts, others were “uncurrent” money and, as such, were generally refused altogether by bankers and by merchants, who typically accepted only notes considered bankable by their own banks.

Here’s a partial listing, from an 1858 publication typical of many of the kind, of notes that were then bankable in Cincinnati:

The larger discounts applied to doubtful notes were, in contrast, ones charged by professional banknote brokers, who based them on estimates of the liquidation value of the issuing bank’s assets. In short, such notes resembled equity claims rather than money, and were seldom employed in ordinary exchange. By simply emulating merchants’ habit of accepting locally bankable notes only, ordinary citizens could spare themselves any risk of having doubtful notes fobbed off on them. To that extent, it was less difficult for those citizens to know “what to make” of different banks’ notes than Greenberg suggests.

Risks Aplenty

This isn’t to say that navigating the antebellum currency market was a cinch. On the contrary: thanks to barriers to branching and the “spoils” system by which most banks had to secure their charters, antebellum banking markets presented well-connected shysters with all sorts of opportunities for bilking their fellow citizens.

Consider the case of the Bank of East Tennessee, the notes of which Greenberg offers as an instance of just how bad things could get. In December of 1856, he observes, a run on the bank caused brokers in New York City to put a 75 percent discount on its notes, even though those notes had been current money in Tennessee earlier that same year.

But the Bank of East Tennessee was far from being a typical antebellum bank. According to one numismatist’s account, its brief history (although it was chartered in 1843, it had only opened for business in 1849) “involved villains, honest men, politicians, a bitter dispute between one major stockholder and the directors of the Bank, a major run on the Bank and its recovery, and finally, the death of the Bank in the wake of the national depression of 1857.” After the bank failed, William Brownlow, publisher of the Whig, an influential anti-secessionist newspaper, and future Tennessee Governor, accused its directors “of swindling money from low-level depositors to pay the bank’s wealthy creditors,” forcing some to flee the state.

Such cases make for exciting story-telling. But using them to illustrate the general state of the antebellum currency market is highly misleading. Although the Bank of East Tennessee was far from being unique in ultimately failing to pay its noteholders in full, most antebellum bank failures resulted, not from their directors’ double-dealing, but from having insufficiently diversified portfolios, often consisting of large holdings of junk bonds that state authorities made them buy as a condition for issuing notes.

Worth 1000 Words (But not Much More)

A striking part of Greenberg’s talk, and one that suffers from the numismatist’s mindset, concerns the part that the design of particular antebellum banknotes played in securing the public’s confidence in them. Americans, Greenberg says, needed to “accumulate as much monetary information as they could every time they needed to use a banknote.” As I’ve already suggested, this is hyperbolic: it sufficed for them to know which notes were locally bankable, and to leave others for brokers to deal with.

But let that pass. Greenberg’s really striking claim is that, as a source of monetary information, “There was really no better resource…than the seemingly endless collection of vignettes and imagery and symbols on the notes themselves.” Cleverly-designed banknotes, Greenberg says, could “forge an emotional connection” between their holders and the banks that issued them, thereby winning noteholders’ confidence, keeping notes they admired circulating longer, and enhancing the profits bankers’ float profit.

To be blunt, this is fantastic. Greenberg errs most fundamentally in assuming that confidence in a bank’s notes suffices to keep them in circulation. Instead, antebellum banknotes tended to circulate only for as long as it took them to find their way into a rival bank’s till. From there they were quickly sent on their way to their source, either directly or through a clearinghouse. Depending on the distances and clearing arrangements involved, this might not take very long at all. For example, thanks to the Suffolk System—a private, centralized banknote redemption arrangement set up by Boston’s Suffolk Bank in the 1820s, in which practically all New England banks participated—a note issued by any New England bank was likely to be returned to it in less than a fortnight.[1] The designs on the note made absolutely no difference. Likewise, if notes issued outside of New England sometimes stayed in circulation for considerably longer periods, that had nothing to do with their having less fetching engravings. Instead it reflected the greater difficulties and delays encountered in getting them back to their sources.

If people didn’t rely on notes’ engravings to decide whether or not to accept them, what “better resource” could they turn to? For starters, there were those lists of bankable notes already referred to. But those were mainly relied upon by merchants. Ordinary folk had a still simpler way of deciding what notes to accept, which consisted of refusing any save those from (mostly local) banks with which they were familiar. If that also seems like it must have been a great burden, then consider that it was no different than the solution ordinary persons routinely relied upon to discriminate between checks drawn, not just upon hundreds, but upon more than twenty thousand different banks, as recently as half a century ago! The only difference is that, whereas someone deciding whether or not to accept a banknote had to have reason to believe that the bank was sound and the note genuine, anyone who accepted a check also had to have reason to believe it wouldn’t bounce.

This isn’t to say that banknote engravings and other devices served no useful purpose. They were indeed important, but only for the same reason that similar devices found on today’s official paper monies are important, namely, as means for combating counterfeiting: the more elaborate the devices, and the more costly the means required to reproduce them accurately, the easier it was for fakes to be detected, and the greater the risk involved in uttering them. For this reason someone to whom an antebellum banknote was proffered might have been well advised to scrutinize it, not to “forge a connection” with it, but to make sure it wasn’t itself forged. But once having satisfied himself or herself that the note was genuine, the same person would have been foolish to assume that, because the note bore impressive and apparently authentic engravings, the bank that issued it must also be sound!

Titillating Toms

In a humorous aside, Greenberg claims that some notes were designed, not merely to aid their own circulation, but to quicken that of their holders, by sporting designs that were naughty, if not downright pornographic.

As evidence, Greenberg offers a $2 note purportedly issued by the Commercial Exchange Bank of Terre Haute, Indiana, the plates for which were engraved by Waterman Ormsby, the founder of the Continental Bank Note Company who, despite having crusaded for more counterfeit-proof currency designs (concerning which he published a now-celebrated volume), is said to have been none-too particular in his choice of clients. Greenberg claims that the note was actually spurious, as there was no Commercial Exchange Bank of Terre Haute, and the fact that the notes were often stamped “Guaranteed and redeemed at Keokuk, Iowa, by the Keokuk Exchange Bank,” for which there is also no record, suggests that this was indeed so.

But Greenberg’s claim that the Commercial Exchange Bank’s $2 notes doubled as soft porn seems no less fanciful than the bank itself. If the reclining, scantily-clad women on the note’s obverse (immediately below) were meant to be risqué, as Greenberg claims, then what was the United States government up to when it issued the $2 silver certificate shown below it?

In fact, sheerly-robed, allegorical females were a staple of both U.S. and foreign currency and coin designs, official and unofficial, throughout the nineteenth century. Thus in his article “The Use of Symbolism in Banknotes,” Hans de Heij, who overseas currency designs for the Netherlands central bank, considers the design of the Commercial Exchange bank’s $2 note as nothing more than a representative instance of “female allegorical figures, representing human virtues,” presumably without having had his tongue planted firmly in his cheek.

If Greenberg’s imagination gets the better of him in interpreting the phony Indiana banknote’s design, it runs positively wild when he turns to the note’s obverse (below). “When you look at it close-up,” he says, “it looks like an interesting…geometric image.” But “held at arm’s length,” it’s “clear” that “it’s meant to represent breasts.” In other words, the note “amounted to portable pornography” that allowed people to get their kicks surreptitiously instead of risking being caught red-handed carrying pornography pure-and-simple.

It’s a shame that, as he eyed the back of that $2 note from different distances to see what thoughts each inspired, Greenberg evidently became too transfixed to spare a glance at the obverses of the same bank’s notes of other denominations.[2] Had he done so, he might have spotted a pattern that should have made him think twice (so to speak) about his portable pornography hypothesis.

Here’s is the obverse of the bank’s $1 note:

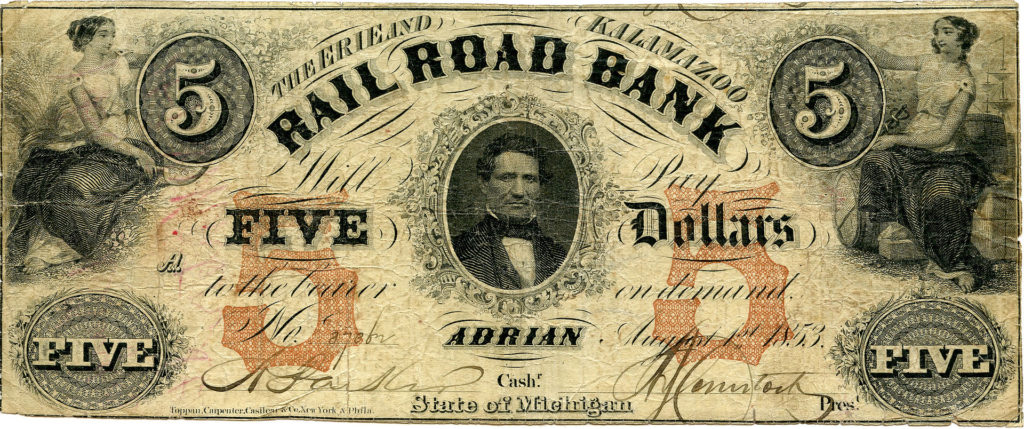

And here’s the fiver:

And, last but most, the sawbuck:

Get the picture?

Getting Even

Finally, I come to Greenberg’s discussion of the steps that did away with banknote discounts by replacing the notes of state-chartered banks with federally-authorized paper money.

Greenberg notes, quite correctly, that these steps were taken in response to “the pressures of the Civil War.” But his account of just what these “pressures” consisted of is quite misleading. According to him, the government wanted to increase its “oversight…in order to try and stabilize currency during the Civil War.” But as any student of the episode knows, and as the timing of the government’s interventions alone might lead one to suspect, the (Union) government’s overarching aim was that of securing the revenue it needed to pay for the war.

That the government’s direct resort to irredeemable paper money—the greenbacks—served that end, is obvious enough. But the passage of the National Currency and National Bank acts served it as well, by creating a new market for Union government debt, which national banks had to acquire as backing for their notes. Senator John Sherman, those measures’ prime mover, may have sincerely wished to see the last of the nation’s discounted and otherwise heterogeneous state banknotes. But it was only owing to the war, and the North’s desperate search for ways to pay for it, that his plan won the day despite long-standing opposition to the Federal governments’ involvement in banking.

Greenberg also fails to account adequately for either the uniformity of the newly-introduced currencies or their success in displacing state banknotes. He notes that the new currencies were “backed by the federal government,” and that, because they were legal tender, greenbacks had to be “universally accepted by law.” But these explanations won’t do. Greenbacks’ legal tender status only obliged people to accept them in settlement of dollar-denominated debts. It remained perfectly legal for anyone to refuse them in spot payments, or to accept them only at a discount relative to other dollar-denominated money, just as it is legally today for merchants to refuse cash payments. And people did discriminate against greenbacks, either by valuing gold coins at a premium, or (on the west coast) by accepting them at a discount relative to gold, just as they had once placed discounts on certain state banknotes. The main difference was that greenbacks commanded less value than gold everywhere, and not just when they traveled far from their Washington, D.C. source.

And national banknotes? It’s often assumed that federal regulation of these notes, including the bond-backing requirement to which they were subject, sufficed to keep them at par with greenbacks or, in the case of the “gold” national banks, first chartered in 1870, in gold. But the truth is otherwise. First of all, as was the case with state banknotes, whether it was enhanced by regulations or not, a bank’s solvency didn’t suffice to prevent its notes from being discounted when they traveled far from their sources. Because most national banks were unit banks, just like their state-chartered counterparts, this should have caused their notes to be subjected to the same distance-based discounts applied to notes of sound state banks.[3]

And so it did, but not for long. To remedy this defect, the National Bank Act of 1864, revising the 1863 National Currency Act, stipulated that all national banks had to accept each other’s notes at par, in effect making the whole set of national banks resemble a single bank with many branches. But that solution, far from being satisfactory, created other, serious problems. Concerning these, I refer readers to a lengthy paper on the subject by myself and CMFA Senior Fellow Lawrence White.

Yet even the 1864 act didn’t succeed in achieving a uniform currency, for the simple reason that neither it nor the 1863 act succeeded in getting rid of state banknotes. Instead, those measures merely gave state banks the option of converting to national charters; and while some state banks chose to switch, many didn’t. And this wasn’t simply because state banking regulations were less onerous, as many suppose. Had that been so, and had the public been as perplexed by the variety of state banknotes as Greenberg claims, it would have had every reason to favor national banknotes over surviving state banknotes, and so would have given state banks of issue no choice but to either secure national charters, or somehow manage without issuing banknotes at all.

No: state banknotes survived the two national bank acts not because the banks that issued them were shoddy and wanted to stay that way, but because they’d earned the public’s trust—and not just by having pretty banknotes—and had nothing to gain by switching.

Those who wonder why anyone would prefer less-uniform state banknotes to federally-regulated alternatives may be surprised to learn that, by the time those alternatives became available, the weeding-out of the worst state banks, transportation improvements, and the appearance of bank clearinghouses had caused discounts on state banknotes to decline to trivial levels. As I’ve shown elsewhere, and pointed-out more than once here on Alt-M, had someone bought every bankable state banknote in the country in October 1863, paying their full-face value in greenbacks for them, and then sold the notes to a broker in either New York City or Chicago for their market value in those cities, that person’s loss would have amounted to less than one percent of his investment. And don’t forget that most people only dealt with notes from familiar banks they considered reputable, the discounts on which would be much lower than the average, assuming they were discounted at all.

What’s in a Name?

It was because many state banks were highly regarded that very few chose to switch to national charters. That was especially so while the original National Currency Act was still in effect, for that law called for them to give up not just their state charters but their good names, and to settle for the indistinct alternatives like “The 5th National Bank of Peoria.” It was because so few wished to throw-away valuable brand name capital that the 1864 act changed the rules by allowing them to incorporate their old names into the new ones, e.g, “The Merchants and Mechanics National Bank of Peoria.”

But even that concession failed to convince many state banks to join the new system. Consequently federal authorities found it necessary to take a further, Draconian step that Greenberg fails to mention, by imposing a punitive, 10 percent annual tax on all remaining state banknotes. Although it was passed as part of the March 3, 1865 Revenue Act, the tax didn’t ultimately take effect until August, 1866. So it was only then that the U.S. finally secured a uniform currency, not in order to satisfy the public’s wants, as so many suppose, but despite those wants.

Consider the notes of the Millers River Bank of Athol, Massachusetts, which was housed in the little neoclassical building shown in the postcard below until 1888, when it moved into the Richardson-Romanesque building in the foreground.

Displaying an 1860 $3 note from that bank, Greenberg observes that, in 1865, the bank converted to a national bank at the start of 1865.[4] What he doesn’t say is that this note, like those of all New England banks in good standing at the time, was accepted at par throughout that region, and at a discount of just one-fifth of one percent in most other places, including in New York City. For the vast majority of transactions that were likely to involve them, notes like it were, literally, as good as gold.

_____________________

[1] The reality of banknotes’ brief circulation periods under the Suffolk System contrasts sharply with Greenberg’s understanding of that system’s workings, as reflected in his response to a listener’s question regarding it. The Suffolk System, he says, “worked quite well.” But it also “provided a false sense of confidence for the member institutions,” causing them to believe they could “issue as many notes as they want…because they have the backing of the Suffolk system.” He then claims that New England banks took advantage of this to issue “huge numbers of notes…and [dump] them in the Midwest.” There is, in fact, no truth to this last claim, which confuses notes of legitimate New England banks with fraudulent copies sometimes fobbed off on hapless Midwesterners. It was only because the genuine banks didn’t over-issue notes that fraudsters chose to fake their notes rather than those of less reputable banks! And, far from making it easier for its members to over-issue, the Suffolk system made it impossible for them to do so, by quickly returning their notes for redemption. Any member that over-issued would therefore quickly find itself running short of resources with which to replenish its Suffolk-bank settlement balance.

As for New England bankers ultimately abandoning the Suffolk system in 1858, in order to join another arrangement (The Bank for Mutual Redemption) of their own design, that had nothing to do with either their desire to avoid being tempted to over-issue banknotes or their desire to issue more notes than the Suffolk system allowed them to. Instead, it was prompted by the Suffolk Bank’s stiff membership terms, including its unwillingness to pay them any interest on their settlement balances, and the banks’ desire to avoid the conflict of interest involved in having one of their rivals double as a regulator.

Finally, while the Suffolk system might be said to have “crumbled” when its rival was formed, that didn’t mean that New England was left without a well-regulated currency system. Although little is known about the Bank for Mutual Redemption, which functioned only for a few years, there is no reason to suppose that it was less capable of keeping its members in line than the Suffolk itself had been. Far from being problematic, its club-like structure resembled that of most other private clearinghouses: it was the Suffolk that was exceptional. But we do know the one fact that matters most, to wit: that even after the outbreak of the Civil War, but before state banknotes were taxed out of existence, New England’s state banknote based currency was as uniform as ever.

[2] Just kidding, Joshua!

[3] In what must be reckoned one of the most tragic decisions in the history of U.S. financial regulation, Hugh McCulloch, the first Comptroller of the Currency, took it upon himself to interpret the National Currency and Banking acts as providing for unit national banks only, as opposed to banks enjoying the same, nationwide branching privileges as the first and second Banks of the United States.

Thanks to McCulloch’s decision, the federal government missed a unique opportunity to establish a system of competing nationwide banks, similar to Canada’s later in the century. Besides eliminating banknote discounts, doing that would have established a much more stable and better-diversified banking system. Instead, it would take another century and a half for nationwide branch banking to become thoroughly, if still not quite completely, established.

[4] Alas, the bank was among those that closed, never to reopen again, during the national bank holiday of March 1933. It was eventually placed into receivership and liquidated.

The post Joshua Greenberg on Antebellum Paper Money appeared first on Alt-M.