Inflation, also listed as the number one ‘public enemy’ by President Gerald Ford in 1974, is basically a situation where everybody is so rich that nobody can afford anything. A common tool used to measure inflation is the Consumer Price Index (CPI)- the cost of a given basket of goods at a particular time relative to a base year. A rise in inflation implies a reduction in the consumers’ real income, income adjusted for inflation, or in other words, their purchasing power. Hence, to ensure equal access to affordability to all consumers, it is essential to keep inflation in check, which is precisely the primary objective of the Central Bank of a country and it uses various monetary policy tools to do so.

Ever since the pandemic, the global prices have been on a rise. This is largely due to supply disruptions which has reduced production in economies. It implies an obvious contraction of the GDP and per capita income, and also a rise in unemployment. According to the latest statistics released by the Central Statistics Office, the Indian GDP has contracted by 7.1 percent in FY 2021; while the unemployment rate is at an all time high of the past 29 years at 7.11 per cent.

The supply shocks in the economy have disturbed the general price levels of commodities in the economy. Due to the supply not being able to match the demand, the economies globally have witnessed a general rise in price levels, also known as cost-push inflation. Due to widespread lockdowns across countries, the avenues for consumption have gone down as well, implying an increase in savings.

Globally, economies also saw a rising pressure on fiscal policies as the public and corporates turned towards their governments for relief packages and economic stimuli respectively. Inflationary pressures have led to a resulting fall in nominal interest rates, which implies low investment, which ultimately means low economic growth. Global central banks- the inflation hawks- have been waging a war against inflation while at the same time trying to boost inflation. But one comes at the cost of the other.

India, like all other economies, has been hurt by the pandemic. The Wholesale Price Index (a measure of inflation) has grown exponentially to 7.39 percent, as manufacturing has almost 65 percent of weightage in the WPI. Whereas the CPI has also seen an increase, not as profound as the WPI, in particular because of a hike in food inflation due to the global rise in prices of edible oil. Moreover, the Indian Rupee has been depreciating consistently due to the Reserve Bank of India choosing to keep interest rates low on government bonds.

With inflation on the rise globally, India is bound to be impacted. With a weakened rupee and hiked prices worldwide, imports for India, particularly crude oil, metals and edible oils have become expensive. With India becoming a global hotspot for Covid, foreign portfolio investors have also started pulling out of the Indian economy. With the world recovering and India facing shortages of vaccines and a solid healthcare infrastructure, India is bound to fall behind in the economic recovery from this recession.

The announcement of the $3 trillion package by the Biden government has raised expectations of inflation in the future. Although the Federal Reserve has claimed that it will keep the interest rates lowered and keep buying government bonds, it is highly likely that the interest rates will go up by the end of the year. Moreover, with the advent of the vaccines to the deadly virus and a large part of the public being administered with the vaccine, the US economy is picking up. The American economy is treading the path of recovery and there is an expected surge in the consumption levels of Americans due to the savings they were ‘forced’ to do as major avenues for consumption closed down.

As the European economies have been opening up, they have seen a sharp rise in inflation. The current inflation is just a little above 2 per cent, with 2 percent being the upper cap of the European Central Bank’s inflation target. This rise in inflation is expected to go up, although it will be transitory. This increase in inflation is largely driven by an increase in energy prices. When the pandemic struck, the energy market took a hit. Prices fell drastically. But now that economic activity has been recovering, the energy market is rebounding.

Interestingly, the energy prices are 13% higher relative to the previous year in the Eurozone. Whereas, the Japanese economy that has been battling a chronic case of mild deflation throughout the previous decade, will ultimately see some inflation but will soon fall back into its low-inflation trap.

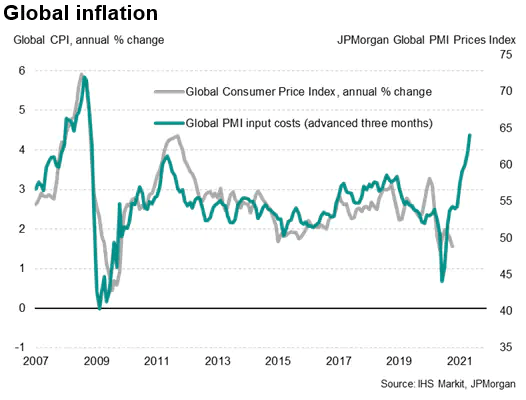

Since the Financial Crisis of 2007-09, inflation rates worldwide have been gradually falling. After almost a decade of falling inflation, and moving towards monumentally high inflation is bound to disrupt the global economic scenario. Some have suggested pumping in lots of fiscal stimulus (which eventually amounts to higher inflation) while some have suggested using unconventional monetary policy during an unconventional time. There are various experiments being done to stabilise prices and boost economic growth, but the question remains that after a decade of lowering inflation, are we heading towards a turning point where inflation will be more difficult to control than ever?

Written by- Iksha Gupta

Edited by- Radhika Khandelwal

The post Rising Inflation: The New Normal? appeared first on The Economic Transcript.