Nassim Nicholas Taleb (henceforth referred to as NNT) identifies ‘Black Swan’ as an event possessing the following three characteristics:

-An outlier, an event that lies outside the realm of regular expectations.

-An event that carries an extreme impact.

-In spite of its status as an outlier, humans try their best to concoct an explanation for the same, shifting its position into the realm of both explainable and predictable.

According to NNT, this combination of low predictability and high impact means that Black Swan events are a great puzzle and a source of endless fascination for the author. By his definition, 9/11 and the subsequent rise of Islamic fundamentalism is a Black Swan event. The rise and massive proliferation of the internet with companies like Google fall under the same category.

Perhaps a far more accurate and timely example would be the current COVID-19 pandemic, a health and economic crisis that brought the entire world to a halt for months at a time (though the author has described himself as ‘irritated’ when the current pandemic is described as such, he believes it is a sign of far more disastrous events to occur and not an outlier event).

The book is written in a clear, sequential manner; flowing from the literary to the scientific. Human psychology is at the forefront of Part One and early sections of Part Two whereas the latter parts of Part Two and the entirety of Part Three focuses on the natural sciences. As obvious to any reader, the author derives great personal pleasure from the subject matter, indicated clearly by the plethora of personal anecdotes scattered throughout the book.

Part 1 of the book focuses on how humans seek validation from the outside world and how it influences our decisions. Seeking validation is an integral part of human nature, more so after the advent of the Internet. Social media companies profit off of our insecurities, raking in billions of dollars each year. When a Black Swan event occurs, the first instinct of the human mind is to formulate reasoning by which our minds can make sense of it, validating our prior assumptions about how the world must operate.

NNT employs an unfamiliar methodology to look at history: he describes the discipline as fundamentally opaque. Reading about battles or wars form only the tip of the iceberg. We do not understand the mechanisms behind their decisions, why they did what they did, leaving our understanding incomplete. Due to this, we mistakenly perceive the world as more explainable than it actually is – forming our own explanations using our personal biases and using the same methodology to explain Black Swan events.

Our education system also plays a role in how we perceive Black Swan events. Schools discourage discourse and saying ‘I don’t know’ to a question is looked down upon. When this mindset is ingrained in young children, as adults, it is natural to avoid ambiguity and formulate the quickest and the easiest conclusion.

Probability is the mother of all abstract notions and the bedrock of discussion in Part 2. While everyone is familiar with how easy it is to lie with statistics, there are inherent limitations to the kind of conclusions we can draw; limitations with the information itself, not in human nature.

NNT poses an interesting question early on in the book. Why didn’t the bubonic plague kill more people? While there are numerous explanations for the same (reasons concerning the scientific study of diseases), NNT poses a counter-argument: had the plague killed more people, we would not be here to ask that question in the first place. This anomaly concerning the severity of the disease was an inherent characteristic of the disease itself and not a flaw of human nature. Thus, using prior knowledge to predict the severity of a disease (as a lot of statisticians would do), would yield an inaccurate result.

So how should we proceed? We could use our common sense and draw inferences based on how realistic a possibility is. But our common sense is shaped by our personal experiences and biases. It can never be objective.

If we cannot predict the future, how should we insure ourselves against Black Swan events? Fortunately, NNT comes to our rescue once again. Since human risk assessment is fallible i.e predisposed to prediction errors even when it is not our fault – the best strategy is to be either hyper-aggressive or hyper-conservative rather than mildly aggressive or mildly conservative. As a former financier himself, he uses a familiar example of investments to prove his point.

To effectively protect one’s investments against a Black Swan event, one must put 85 to 90% in extremely safe investments (like Treasury bills) and the other 10 to 15% in extremely speculative bets. In this way, the investment is not dependent upon risk management errors nor on Black Swan events. When such an event occurs, they are cushioned by safe investments.

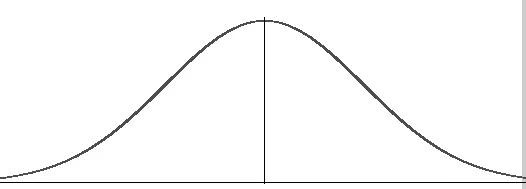

Part 3 of the book operates entirely within the realm of natural sciences and in particular, the bell curve (the graph of a normally distributed variable looks similar to an asymmetrical bell, hence the name). The primary targets in Part 3 are individuals who use the bell curve to predict Black Swans, the consequence of which is that we fail to predict the probability of highly unlikely events. As NNT points out, a turkey using the normal distribution to predict his future would never be able to predict his death on the night before Thanksgiving. This section of the book is by far the most technical one but a basic understanding of Statistics (or a quick Google search to explain the concepts) is enough.

While NNT has a fantastic sense of humour and reading the book can be described as having a long conversation with a good friend, it is not without its faults. A common criticism for the author’s writing style is that there is too much of the author in it. While his personal anecdotes make the experience more enjoyable, it is not difficult to see why a prospective reader may be put off by it.

The tone of the book is very much indicative of an ‘Us vs. Them’ scenario. NNT occasionally comes off as pompous and arrogant and by the third section of the book, you will not be faulted for believing that the same point is being repeated over and over again. The book could have functioned much better without the clutter, but some may argue that his personal notes enrich the book rather than take away from it.

However, the relative strengths of the book and the subject matter nearly make up for its faults. The entirety of the book may be summed up by one quote, “You cannot ignore self-delusion.” There are unknowns within the realm of possibility that we know about and unknowns that we do not and the problem with experts, the very individuals that we look upon for guidance, is that they are not aware of the gaps in their knowledge.

Overall, despite my own misgivings, I would highly recommend that one read this book even though you must trudge through chapters and tales that do not add to its understanding at all. The book could have easily been one-third of its length and still proved its point effectively.

Written by: Anusha Paul Choudhury

Edited by: Oishika Ghoshal

The post The Black Swan: a Book Review appeared first on The Economic Transcript.