Daniel Raisbeck and Gabriela Calderon de Burgos

When we published our Cato Institute Policy Brief (“Argentina Should Dollarize, Pronto,”) on July 27, few outside of Argentina were paying attention to the dollarization debate. This changed on August 13, when Javier Milei, the only pro‐dollarization candidate taking part in the primary elections, won a surprise victory, thus unleashing a barrage of commentary about the supposed dangers of dollarizing the Argentine economy. Many commentators, however, appear to rely on theories that do not reflect the actual experience of dollarization in three Latin American countries: Panama, Ecuador, and El Salvador. In this post, we attempt to refute some of the most salient myths about dollarization in Latin America.

1. Dollarization leads to a loss of competitiveness and weak growth.

False: The main advantages of dollarization are a) it ends currency devaluation / depreciation b) it prevents the political class from monetizing the debt and causing high inflation à la Argentina.

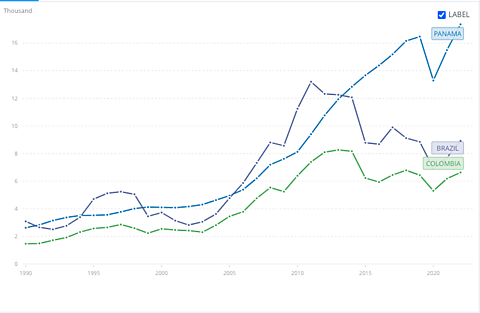

Those advantages do not take away from a dollarized country’s ability to be economically competitive and maintain above‐average growth. See the case of Panama, which dollarized in 1904. In recent decades, Panama’s economic growth has been among the highest in the region, and its current level of per capita GDP far exceeds those of non‐dollarized peers such as Brazil and Colombia.

Source: World Bank

While some argue that Panama’s success is due to the Panama Canal, the proceeds from the Canal’s activity as a percentage of GDP has been less than what other countries in the region obtain by exporting a single commodity. Rather, Panama’s economic strength is based on its open, internationalized banking system, which allows the country to attract foreign capital and guarantees liquidity in the economy.

A country does not become competitive via currency devaluation or depreciation. Were that the case, Argentina today would be extremely competitive, but it is not. Conversely, if an economy became competitive by devaluing its currency in real terms, then Japan would have become significantly less competitive while its currency appreciated by 176 percent versus the U.S. dollar between 1960 and 2004. However, the Japanese economy enjoyed an export boom during said period. On the other hand, the Colombian peso depreciated by 48 percent between 1960 and 2004, yet its exports grew half as fast as those of Japan.

As Manuel Hinds, a former finance minister in El Salvador, explains, Japan succeeded not by devaluing its currency, but rather by “shifting from lower‐ to higher‐value‐added production when the currency appreciated in real terms. Germany did the same [in the post‐war period]. That is true competitiveness.” Hinds adds that devaluation merely favors the profitability of current, lower‐value‐added production and deters a shift towards higher‐value‐added production.

2. Because growth has been slow in Ecuador and El Salvador, dollarization has not succeeded there.

False: Ecuador has not put in place the right supply‐side policies to generate Panama‐like economic growth, and El Salvador has backtracked in this respect since the 2000s. Dollarization is not a silver bullet. It needs to be accompanied by other pro‐growth policies that have been absent in Ecuador and El Salvador, thus their mediocre growth since they dollarized in 2000 and 2001 respectively.

Nonetheless, dollarization has succeeded in both countries because their dollar regimes prevented fiscally profligate, hard left‐wing governments from de‐dollarizing, re‐introducing weak currencies, and monetizing the debt (Rafael Correa in Ecuador and the FMLN in El Salvador).

As a result, both Ecuador and El Salvador have faced fiscal crises in the last few years. However, said problems have not affected the average citizen, who has maintained a sound currency and some of the lowest inflation levels in Latin America.

Also, as citizens of dollarized countries, Ecuadorians and Salvadoreans benefit from far lower interest rates and longer loan periods than under “monetary sovereignty” regimes. Plus, dollarization imposes an intrinsic hard budget constraint on both their governments and parliaments. Hence, those countries’ fiscal situation likely would have been much worse under a national currency.

3. Dollarization failed in Argentina in the 1990s.

False. In the 1990s Argentina had a currency board that exchanged dollars for pesos, a system and that is sometimes confused with dollarization. In fact, equating that exchange‐rate system with dollarization is misleading. As Professor Steve Hanke explains, “There are three distinct types of exchange rate regimes: floating, fixed, and pegged—each with different characteristics and different results” (see the table below).

Source: Steve H. Hanke, “A Money Doctor’s Reflections on Currency Reforms and Hard Budget Constraints,” in Public Debt Sustainability: International Perspectives, eds. Barry W. Poulson, John Merrifield, and Steve H. Hanke (Lanham, MD: Lexington Books / Rowman & Littlefield, January 2022), pp. 139–69.

Given the differences between exchange rate regimes, it is incorrect to ascribe the main characteristics of dollarization to a currency peg, which can be changed or done away with. This is not the case with dollarization, whereby a country replaces its currency with the U.S. dollar at a given rate and grants the latter legal tender (de‐dollarization is most feasible under a totalitarian regime such as Robert Mugabe’s in Zimbabwe). A peg also leaves a country with monetary policy faculties, a partly domestic source of the monetary base, and, hence, the possibility of a balance of payments crisis. None of these factors are present under dollarization.

An orthodox currency board provides an alternative version of a fixed exchange rate regime. Once in place, it sets the exchange rate but carries out no monetary policy, so that the foreign‐based monetary base remains, as Hanke writes, “on autopilot.” Under a currency board—as with dollarization— the balance of payments determines the monetary base as it moves “in a one‐to‐one correspondence” with any changes in foreign reserves. This prevents monetary policy and exchange rate policy from colliding, thus precluding balance of payment crises (as is the case in floating rate systems).

Had Argentina implemented an orthodox currency board in the 1990s, it would have carried out a fixed exchange rate policy but no monetary policy (such a currency board acts as a straitjacket on the local monetary authorities). Under official dollarization, the dollar would have had legal tender, the peso would have ceased to circulate, and the central bank would have become obsolete in terms of monetary policy. Neither was the case.

As we explain in our policy brief, Argentina’s convertibility system of the 1990s, which fixed the peso to the U.S. dollar, had several characteristics that made it, in Professor Hanke’s terms, an “unorthodox currency board.” Namely, the central bank still controlled the impact of capital inflows and outflows on the money supply (through sterilization and neutralization), it carried out monetary policy, and it acted as a lender of last resort. The convertibility system even came under a dual currency regime, with different official exchange rates for imports and exports. Each of these features made the convertibility system incompatible with both an orthodox currency board system and official dollarization,

Despite its inherent defects, Argentina’s convertibility system did cause the inflation rate to drop from over 2,600 percent in 1989–1990 to less than 1 percent in 1998. Due to its design flaws, however, the Argentine peso began to lose parity with the dollar in 2001, when currency market speculators smelled blood. In January 2002, Argentina carried out a chaotic exit from its fixed exchange rate.

4. The loss of monetary sovereignty leaves a country at a disadvantage due to the inability to counter external shocks with monetary policy.

False. As Hinds writes, Panama, Ecuador, and El Salvador have all “calmly endured the 2008 and COVID-19 crises with much lower interest rates than in the rest of Latin America.”

Besides, dealing with a crisis by devaluing the local currency might bring the mirage of (very) short‐term relief, but this is offset by the necessary consequences of devaluation: the loss of purchasing power, higher inflation and interest rates (than in a dollarized scenario), and the strong incentive to maintain low‐value‐added production.

In extreme circumstances, finance ministers of developing countries—both formally dollarized and non‐dollarized— head to Washington looking for the same thing: a loan in U.S. dollars from the IMF, the repayment of which becomes more onerous with a weakening currency. As Hinds explains, the IMF’s power lies in its ability to allow developing countries to access dollars, particularly in times of crises and when the market shuts out funding for particular governments.

Consider, moreover, the effects of devaluation. As Andrei Levchenko and Javier Cravino found in the case of Mexico’s 1994 “Tequila crisis,” “the consumers in the bottom decile of Mexican income distribution experienced cost of living increases about 1.25 times larger than the consumers in the top income decile” during the two following years. Hence, the authors conclude that the distributional effects of large devaluations are “anti‐poor”. In Professor Hanke’s words, “when the currency loses value, you import inflation.”

Maintaining a weak national currency might appeal to certain central bankers, who would remain employed and could still act as protagonists in times of crisis, when, according to theory, currency devaluation or depreciation is in the national interest. The very rich are largely unaffected, not least because a large portion of their assets tends to be held already in U.S. dollars or other hard currencies.

For the bulk of the population, however, maintaining purchasing power is of the utmost importance. In fact, as we have seen, a sharp loss in a currency’s value is most detrimental to the poorest segments of the population.

5. Dollarization can lead to very high unemployment levels because of external shocks, while flexible exchange rate regimes can withstand such shocks far better.

False: Panama and Ecuador have proved that dollarized countries in Latin America can maintain low unemployment levels compared to non‐dollarized peers, even those with independent central banks such as Brazil and Colombia.

Source: World Bank

A depreciating currency hinders economic growth in the long term, all things being equal. While a weakening currency might reduce the price of labor, thereby stimulating growth and employment in the short term, it raises the cost of capital in the form of higher interest rates. This discourages investment, which is the source of job creation in the long run.

6. The Federal Reserve oversees all monetary policy for dollarized countries.

False. Although dollarization does take away a country’s ability to set its own interest rates and print its own national currency, while dollarized countries’ inflation rates tend to merge with those of the United States, liberalization of the banking system can grant an important degree of independence.

As economist Juan Luis Moreno‐Villalaz argued in the Cato Journal in 1999, Panama’s banks, which have been integrated to the global financial system after a series of liberalization measures in the 1970s, allocate their resources inside or outside the country without major restrictions, adjusting their liquidity according to the local demand for credit or money. Hence, changes in the money supply—which arise from the interplay between local factors and the specific conditions of global credit markets—and not the Federal Reserve, determine Panama’s monetary policy. Fed policy affects Panama only to the same extent that it does the rest of the world.

7. Dollarization is a U.S. imperialist policy.

False. No official institution in Washington supports or promotes dollarization. The White House and the U.S. Congress are usually disinterested in the monetary policy of Latin American countries. On the other hand, the large multilateral organizations, namely the World Bank and especially the International Monetary Fund (IMF), tend to oppose dollarization initiatives. For instance, when former Ecuadorean president Jamil Mahuad dollarized in early 2000, he did so against the express wishes of the IMF and the World Bank. Unsurprisingly, current and former IMF economists now oppose Argentina’s potential dollarization.

In part, the IMF’s resistance to dollarization can be explained from a public choice perspective. As part of its mission, the IMF provides member countries with “capacity development, which is technical assistance and training of government officials” in different areas, including “monetary and exchange rate policies.” If a country dollarizes, it no longer carries out such policies. Nor does it employ central bank officials for the IMF to train in terms of monetary and exchange rate policies. This is problematic not only for the IMF. In Latin American countries, economists have strong incentives to work for the local central bank. As Professor Hanke argues, a stint at a Latin American central bank has become the equivalent of holding an advanced university degree. Moreover, central bank economists in Latin America often aspire to an eventual post at the IMF itself. In a dollarized country, no such career path exists for economists. In part, this also explains the opposition to dollarization that is often voiced by local macroeconomists.

Another frequent argument against dollarization is that it is economically harmful due to the loss of seigniorage, the price paid to a currency’s issuer. As we explain in our policy brief, however, the so‐called loss involved is small and, ultimately, a minimum price to pay for an end to high inflation. Especially in countries with poor monetary policy, the cost of giving up seigniorage is the equivalent of an insurance premium paid for protection against the higher risks of maintaining a local currency.