“There’s been this move afoot in which markets have become something closer to a mechanism by which to harvest … subsidies, rather than what they were intended to do, which is ensure least cost dispatch of available resources and to incentivize new investment.” –James Danly, Commissioner at the Federal Energy Regulatory Commission

Counting the many reasons to repeal the energy subsidies in the Inflation Reduction Act (IRA) has become my favorite activity. In earlier posts, I examined 1) how the energy tax credits in the IRA could cost taxpayers $2.5 or $3 trillion, 2) why policymakers should remove those subsidies before expanding the high‐voltage transmission system, and 3) the role of the IRA in enabling regulatory overreach at the Environmental Protection Agency.

Another reason to dislike the IRA is that, as written, it hurts the justification for establishing competitive wholesale electricity markets in the first place: economic efficiency. Under the IRA, the role of wholesale electricity markets could be diminished from that of the guarantor of an efficient industry to that of a subsidy clearinghouse.

The Promise of Electricity Markets

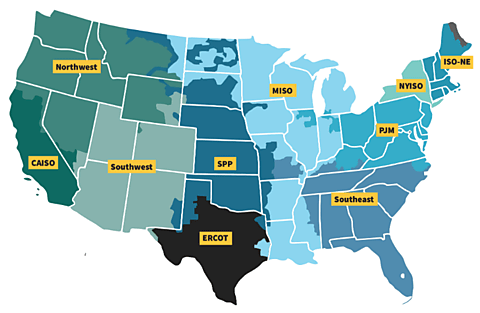

Roughly two‐thirds of the electricity generated in the United States is dispatched through wholesale markets called Independent System Operators (ISOs) or Regional Transmission Organizations (RTOs). For this piece, let’s call these organized markets RTOs. The RTOs were conceived to accomplish one simple but profound task: harness competition to ensure electric reliability at the least cost to consumers.

The 1999 rulemaking by the Federal Energy Regulatory Commission (FERC) that established FERC’s pro‐RTO policy—titled Order No. 2000—clearly stated the purpose of the rulemaking and RTOs: “The Commission’s goal is to promote efficiency in wholesale electricity markets and to ensure that electricity consumers pay the lowest price possible for reliable service.”

The seven RTOs across the United States are listed below and shown in the following image from the FERC website:

California Independent System Operator (CAISO)

Electric Reliability Council of Texas (ERCOT)

ISO New England (ISO-NE)

Midcontinent ISO (MISO)

New York ISO (NYISO)

PJM Interconnection (PJM)

Southwest Power Pool (SPP)

The other regions of the country—Northwest, Southwest, and Southeast—are served by vertically integrated utilities or federally‐owned systems that have not joined RTOs.

Source: https://www.ferc.gov/electric-power-markets

An explainer published by Resources for the Future outlines the key role RTOs play in achieving the economic efficiency promoted by FERC on behalf of consumers:

“RTOs use energy markets to decide which units to dispatch, or run, and in what order. In the day‐ahead market, RTOs compile the list of generators available for next‐day dispatch and order them from least expensive to most expensive to operate. For example, since wind plants operate without fuel, they are able to bid $0 into the energy market and get dispatched first. Dispatching units by lowest cost allows the market to meet energy demand at the lowest possible price.”

There is ample debate about whether RTOs have delivered on the promise of reducing consumer costs. No one has conducted a comprehensive analysis of RTOs versus non‐RTOs and evaluated their success (or failure) in ensuring reliability at the lowest possible cost. However, one thing most observers agree on is this: the least‐cost dispatch of generation assets over a large region brings substantial economic efficiency. If we add the long‐run benefit of deferred investments in new generation assets because neighboring utilities can share reserve margins, the economic case for RTOs is strong.

Although there is a compelling economic case for competition in the electricity industry, RTOs are not free markets. They are FERC‐regulated wholesale markets that operate under a federal regulatory framework of mandatory open access. RTOs promise to deliver savings by optimizing a large fleet of generators. In contrast, utilities operating in silos under cost‐of‐service regulation have less incentive to optimize operating costs and face a strong incentive to overbuild generation capacity. Hence, RTOs represent a different regulatory approach that attempts to create better incentives to deliver lower‐cost reliable electricity.

The Essential Role of Market Prices

Friedrich Hayek won the Nobel Prize in Economics for (among other things) the crucial observation that market prices convey essential information about the ever‐changing state of the world. Market prices are necessary for the full and free use of knowledge in society—Hayek understood this well before the planned economies of the Soviet Union floundered and fell.

As the Nobel Prize website summarizes, Hayek’s “conclusion was that knowledge and information held by various actors can only be utilized fully in a decentralized market system with free competition and pricing.”

RTOs are the closest thing we have to a Hayekian, price‐driven market in the electricity sector. The genius of wholesale electricity prices set in many different locations—called Locational Marginal Prices (LMPs)—is that they convey much‐needed information about the state of supply, demand, and transmission congestion on the power grid. The time‐ and location‐specific prices in wholesale markets can be visualized in an LMP contour map. Below is the MISO map from approximately 5:00pm on October 19, 2023, and the units are US dollars per megawatt‐hour of electricity.

Source: https://api.misoenergy.org/MISORTWD/lmpcontourmap.html

On the supply side, prices not only reflect generator availability in real time but also signal the need for resources in the years ahead. Demand‐side participation remains relatively low in electricity markets, but LMPs enable economic engagement from the demand side, either through direct participation in wholesale markets by sophisticated buyers or through “demand response” programs. Recent rulemakings at FERC also extend wholesale market access to distributed energy resources connected at the retail or distribution level, which broadens the influence of LMPs. In a dynamic market, these price signals create the foundation for economic efficiency.

What Will IRA Subsidies Do to the Economic Efficiency of Markets?

For the most part, RTOs have embraced the goal of economic efficiency for the past 23 years (since Order No. 2000). However, some RTOs have begun to include the “clean‐energy transition” and “environmentally sustainable power system” in their mission statements. Advocates of economic efficiency should be concerned that the IRA will push RTOs further into a new era in which the goal of economic efficiency is secondary to environmental goals or ignored entirely.

As a refresher, the IRA extends the Production Tax Credit (PTC) that is already available to wind generators and, in 2025, applies an inflation‐adjusted PTC to all resources that do not emit greenhouse gases at the point of generation (essentially every form of electricity generation that does not break a hydrocarbon bond as its energy source—nuclear, hydro, wind, solar, geothermal, etc.). This PTC‐for‐all will have profound impacts on wholesale electricity markets and their ability to promote economic efficiency. It has no end date and could cost trillions of dollars.

One predictable impact of a PTC‐for‐all will be an increase in the frequency and magnitude of negative prices. When prices in other industries go negative—such as the brief negative pricing of crude oil futures in April of 2020—it sends an appropriate level of extreme, “visceral” panic to producers. Not so in wholesale electricity markets. Negative prices can emerge as a natural consequence of transmission constraints, inflexible generation resources, or due to large subsidies. They can also reflect the willingness of generators to keep producing—to claim a lucrative subsidy—even if the price of electricity is negative.

The value of the PTC today is $27.50 per megawatt‐hour. In the price contour map above, several of the indicated hubs were trading below that amount (in the range of $25–26 per megawatt‐hour). Again, in most other industries, a federal subsidy larger than the price of the commodity would be unimaginable—people familiar with the industry would sound alarms about the distorting effects of large subsidies. People would be justified in losing their temper, for example, if Congress implemented a new federal subsidy of $70–90 per barrel of crude oil produced in the United States (the going rate over the last year or so). With subsidies larger than the commodity price, will RTOs trade as much (or more) in federal subsidies as they do in electricity?

As researchers at Lawrence Berkeley National Laboratory wrote in 2021, “monetary production incentives such as renewable energy credits or tax credits also enable negative bids; indeed, negative prices predominantly occur when demand levels are low and wind production levels are high.” Likewise, Professor Bill Hogan at Harvard recently explained the perverse incentives negative prices provide to market participants:

“Subsidies produce unintended consequences and undermine the incentives provided by markets. To illustrate, the production tax credit is well known to create a perverse incentive for the wind generator which turns the real zero variable cost into a perceived negative variable cost equal to the amount of the subsidy. The results can be negative energy prices. This, for example, creates an incentive for storage operators to charge and discharge simultaneously, making money while dissipating energy by operating the battery as a radiator and thereby increasing load.”

Being paid to waste energy should be a clear sign that IRA incentives are all wrong. But will it be corrected?

Some champions of organized wholesale markets have more faith in Congress than I do to recognize the problem and enact reforms. One observer stated in a recent piece titled In Defense of Electricity Markets: “it is hard to believe that Congress won’t cut back subsidies if Inflation Reduction Act bills start skyrocketing while government interest payments are stacking up.” One can hope. However, let’s weigh that optimism against the observation that the companies receiving IRA subsidies are not only growing richer but also more influential in politics—the R Street Institute says the “non‐utility renewable energy industry has increasingly been able to compete for influence against incumbent monopolies.”

Providing a PTC for everything could trigger a subsidy contagion. Coal and natural gas are dispatchable generation resources that presently provide 60 percent of our electricity. They are also essential if grid operators are to maintain reliability. Subsidies for intermittent generation will lead to the retirement or bankruptcy of dispatchable resources, which will not only create challenges in maintaining grid reliability but will open the door for subsidies for dispatchable resources (whether or not they are truly needed for reliability). Such a subsidy spiral could be endless and could pit federal subsidies in the IRA against state subsidies for preferred resources, all paid for by American taxpayers or electricity customers one way or another.

Joseph Bowring, the independent market monitor for PJM, offered this wisdom in 2017: “Subsidies are contagious. Competition in the markets could be replaced by competition to receive subsidies.”

Likewise, FERC Commissioner James Danly presented the dilemma facing RTO advocates as follows (at minute 35 of this hearing before the House Energy and Commerce Committee in June):

“If we’re going to set up an electric system in which the success or failure of a generation asset relies not upon the efficiency with which it’s run or the cost of the fuels that powers it but instead the availability of subsidies, then one questions whether or not we need to have markets at all, since the market’s very premise is being undermined ….”

Conclusion

Supporters of wholesale electricity markets should join me in seeking repeal of the energy subsidies in the IRA. Economic efficiency demands it. And if economic efficiency is no longer the goal of wholesale electricity markets, what is?