The purge of conservative and libertarian voices on social media was, as Ron Paul put it, “shocking and chilling, particularly to those of us who value free expression and the free exchange of ideas.” People from the conservative side of the aisle, but also others, have called for solutions like antitrust laws regulation of social media even to downright nationalization of Big Tech companies. Comparisons are made with the so-called robber barons in the late nineteenth and early twentieth centuries. According to popular “wisdom,” people like John D. Rockefeller, Cornelius Vanderbilt, and others made profits due to immoral and unethical competition practices that granted a monopoly status to their companies. Now, just like in the past, government needs to step in to protect the consumer, who is being exploited.

These comparisons don’t help the case for government regulation of Big Tech if we take a close and honest look at the history of antitrust laws.

To understand this, we must first of all make a distinction between, as historian Burton Folsom says ‘”the market entrepreneur and the political one.” Just like in today’s world, the political entrepreneur grows and expands his business not based on the utility and satisfaction that his products provide to the consumer but rather by lobbying and influencing special interest groups in DC to get a subsidy, a tax break for his company, or even to stifle competition through legislation. For example, in recent years Amazon, Apple, Google, and Facebook have dramatically increased spending on lobbying. Meanwhile, the market entrepreneur earns his living by recognizing consumer preferences in the market but also imagining the opportunities and solutions that can arise from his unique abilities.

The Struggle between Political and Market Entrepreneurship in American History

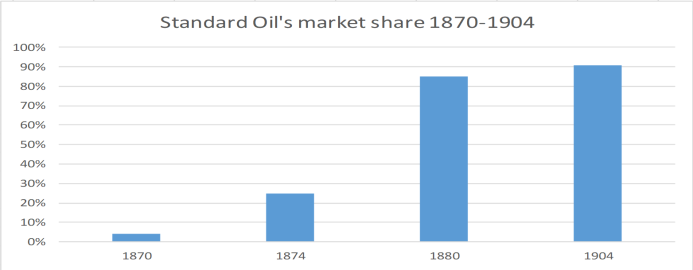

The famous steamship entrepreneur Cornelius Vanderbilt had to compete with political entrepreneurs who received subsidies and special privileges from the government. Vanderbilt started his journey working for Thomas Gibbons, under whom he learned how to operate in the marketplace and worked as a ferry captain, thus defying the steamboat monopoly that the New York state legislature had granted Robert R. Livingston and Robert Fulton. However, Vanderbilt made brave attempts to break this politically enforced monopoly by offering lower prices. In 1824, in the Gibbons v. Ogden Supreme Court landmark case, the state-enforced monopoly ended, giving Congress the authority to regulate interstate commerce. Thus, Vanderbilt’s business grew considerably, though he had still to endure competition from market and political entrepreneurs; however, Vanderbilt didn’t shy away from competing against his rivals, reducing fares on steamboat transit by 90, even 100, percent. (On trips for which a fare was not charged, Vanderbilt earned his money by selling concessions onboard.) By the late 1850s, key competitors had gone bankrupt, because the lines were inefficient due to the government regulations that came with the grants. Another famous man whom most historians have portrayed as evil is John D. Rockefeller. His product was kerosene, but more importantly, it was cheap and affordable kerosene, which made the world brighter, warmer. His Standard Oil Company made the oil industry more efficient. He rewarded innovation from his chemists when they found new ways to get kerosene out of every barrel of oil. He also purchased the many poorly managed operations in northwestern Pennsylvania, making these assets more profitable. Due to economies of scale (costs per unit decline while output increases) the company’s share of the refined petroleum market rose dramatically:

Source: Dominick T. Armentano, Antitrust and Monopoly: Anatomy of a Public Failure, 2d ed. (Oakland, CA: Independent Institute, 1990).

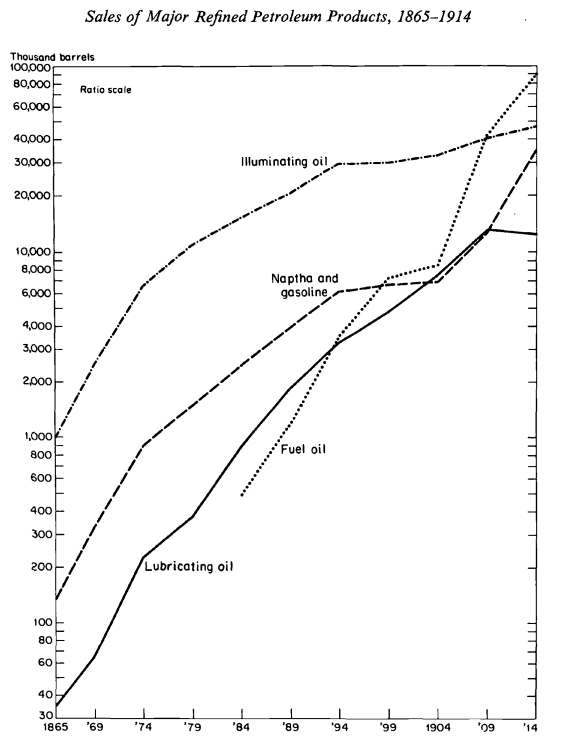

By 1870, kerosene had replaced whale oil in the USA as the main source of fuel for light. Working and reading after dark had become possible for the average American.

Source: Harold F. Williamson, Ralph L. Andreano, and Carmen Menezes, “The American Petroleum Industry,” in Output, Employment, and Productivity in the United States after 1800, ed. Dorothy S. Brady (New York: National Bureau of Economic Research, 1966), pp. 349–404, chart 3 (on p. 381). https://core.ac.uk/download/pdf/6876733.pdf.

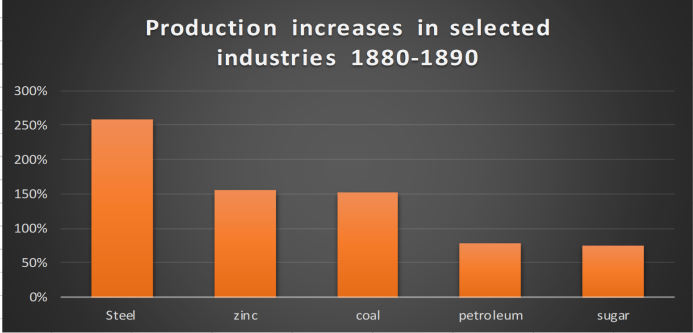

We also have to mention here that claims about rising, stagnant, or restricted output at that time by the so-called monopolists have to be outright dismissed. Economic historian Thomas DiLorenzo wrote that, in fact, during the 1880s, when real GDP rose 24 percent, output in the industries alleged to have been monopolized rose 175 percent in real terms. Prices in those industries, meanwhile, were generally falling, and much faster than the 7 percent average decline in the economy as a whole.

Antitrust Laws

Seeing the massive success of Rockefeller and his company, his competitors started a political crusade to get the government to regulate the industry. Specifically, they wanted antitrust laws that would harm Standard Oil.

Yet even before the passage of the Sherman Antitrust Act of 1890, many special interest groups had managed to successfully use government regulation to harm their rivals. For example, farmers in the South pushed for antitrust laws to stop the decline in cotton prices and agricultural products. In 1906 the federal government had brought an antimonopoly suit against Standard Oil, with accusations of predatory pricing but also that the company was too large and that there would be more competition if it were divided. Wartime (but also post–World War I) measures effectively cartelized the American petroleum industry. Finally, during the Great Depression, the NRA (National Recovery Act) raised import duties and tariffs to protect the industry from competition.

[Read More: God’s Gold: The Story of Rockefeller and His Times by John T. Flynn]

But was the case for antitrust laws justified? Was it sound economically for the consumers? First of all, Standard Oil’s market share was in decline even before the case, dropping from 91 percent in 1904 to 64 percent by 1911. The theory of predatory pricing also falls short not only because there is no empirical backing for it, but because it’s absurd to assume that businesses would choose to lose money for many years in the hope of achieving monopoly status. How many years this would take remains unclear. Without a government-protected monopoly, there also is no way to be sure that a new entrepreneur won’t enter the market and drive prices down again. Many economists who have extensively researched antitrust, such as Dominick Armentano, have concluded that most of the time these regulations have instead harmed competition, productivity, and efficiency, restraining and contributing to the deterioration of the competitive position of the USA economy. The late nineteenth century, before the trusts were enacted, was a time of falling prices and increased production. As the following data shows, the industries which were the most accused of monopolistic practices were increasing their output.

Source: Thomas J. DiLorenzo, “The Origins of Antitrust: An Interest-Group Perspective,” International Review of Law and Economics 5, no. 1 (June 1985): 73–90.

The reality is that none of this mattered to Congress, because these conditions were driving out of the market the less efficient, higher-priced competitors who had political connections. The Sherman Antitrust Act was clearly designed to protect these people. As Armentano puts it:

Antitrust policy in America is a misleading myth that has served to draw public attention away from the actual process of monopolization. The general public has been deluded into believing that monopoly is a free-market problem and that the government through antitrust enforcement is on the side of the ‘’angels’’. The facts are exactly the opposite. Antitrust served as a convenient cover for an insidious process of monopolization in the marketplace.

It is thus clear that historically government was and still is the real cause behind monopolies and industrial cartelization. However, much of the public still believes that there is an inherent tendency toward monopoly in a capitalist economic system.

Just as in the past, more regulation isn’t the answer, in fact it will only empower Big Tech, leading to more lobbying and corruption, resulting in less competition and innovation. Enemies of the free market have infiltrated the minds of the public with a mix of oversimplified history and facts, and bad economics. Their solutions to the problems are even worse, and end up hurting, in the long run, the consumer. Big Tech giants like Google and Facebook have been ahead of their competitors by developing new products at little to no cost for consumers. Which is the exact opposite of what happens under a monopoly (rising prices plus restriction of output). To minimize the effects of censorship on social media, the answer is, once again, less regulation and more competition.