A study conducted in Nepal, monitoring the effects of easily accessible, no-fee accounts offered to female heads of households living in slums, showed that while there was no evidence of an increase in assets, it did lead to an increase in spending on education and eventually, a rise in the schooling levels of their daughters and the educational aspirants of the parents. Further, households reported of being in a better position to deal with health emergencies and other unexpected expenditures.

Similar research experiments conducted across the globe have shown that – when included in the financial system, people are better equipped to manage risk, start or invest in a business and fund large expenditures like education or home improvements.

Disproportionately burdened by poverty, primarily resulting from social norms, women stand to benefit more from financial inclusion. Women’s access to affordable financial services is not only imperative for poverty reduction, but also for their improved economic agency. According to a UN study, one in three married women from developing countries has no control over household spending on major purchases for the household.

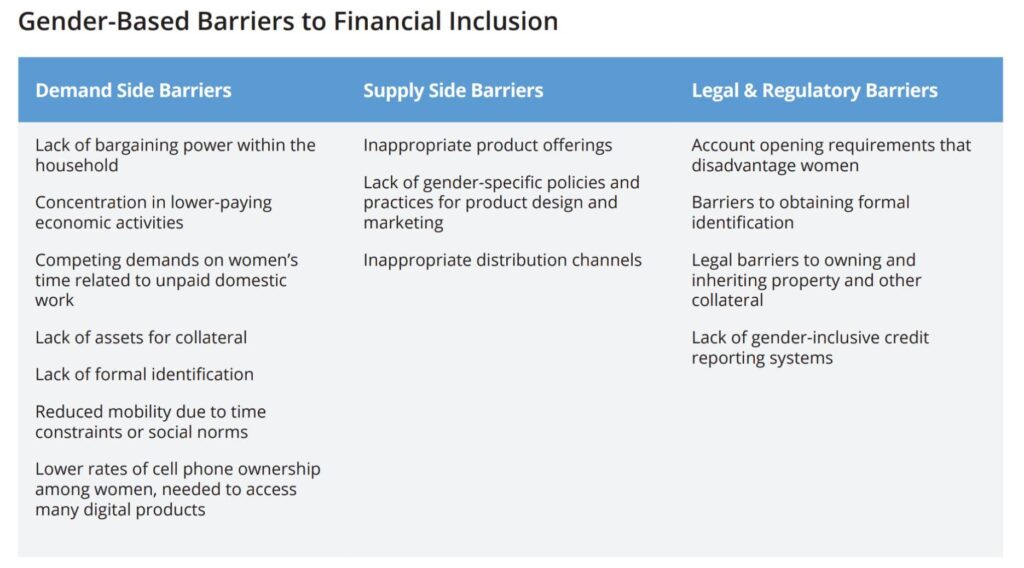

The road to women’s financial inclusion is ridden with barriers. The prevailing financial system fails to accommodate the gender-specific barriers women encounter on the path to financial independence. These barriers include demand-side, supply-side as well as legal barriers. While many schemes may have aided the cause of account ownership, few have been able to tackle the structural hurdles in order to ensure utilization of accounts.

The PradhanMantri Jan DhanYojana (PMJDY), for example, was initiated in 2014 to achieve universal access to banking services. The scheme helped reduce the gender gap in account ownership, which fell from 20 percentage points in 2014 to just 6 percentage points in 2017. The percentage of women owning an account at banks as well as other financial institutions rose from 43% in 2014 to 77% in 2017.

However, as mentioned before, account ownership and account usage are two different battles. As of January 2020, 18.7% of 378 million JanDhan accounts were dormant. Further, while the gender gap in account ownership may have reduced, the gender gap in the usage of these accounts has remained at 11 percentage points. The reasons for the dissonance in ownership and usage are many.

A study, similar to that conducted in Nepal, recorded that providing basic savings accounts to low-income women in India had no perceived effect on their employment, earnings or the rate of utilization of these accounts. However, imparting basic knowledge of account features did lead to increased usage of bank accounts indicating that the lack of basic literacy and technical know-how was as much a barrier to financial inclusion as was the absence of account ownership.

In addition to low literacy rates, other gender-specific barriers include concentration of women in low-wage jobs, restraints on mobility due to social norms, lack of asset ownership for collaterals, etc. Manuela Günther, from the Overseas Development Institute, reviewed the performance of the PMJDY by analysing data from before and after the scheme was implemented and found that those with higher account usage were employed, received at least a high school education and owned mobile phones. Historically, education, employment and digital infrastructure are structural barriers that have disproportionately affected women.

Another notable innovation proposed for financial inclusion is – Fintech. It is an emerging model of banking that replaces the traditional banking processes with faster, more convenient and cost saving methods. Maintaining a bank account can be costly, time consuming and cumbersome. Thus, the use of softwares and digital platforms in the delivery of financial services has the potential to increase account usage.

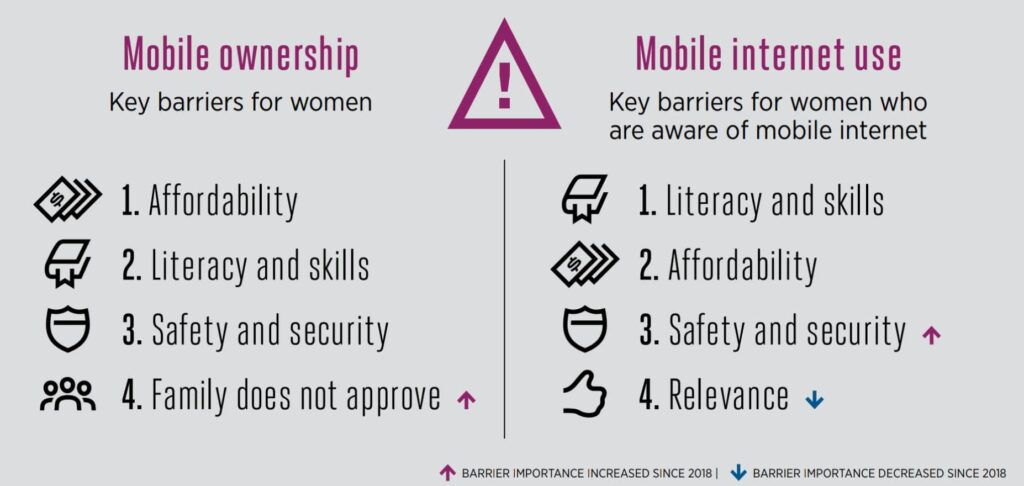

However, for the benefits of digitalisation to materialise a well-established digital infrastructure, that is accessible by everyone, is essential. According to the findings of the Mobile Gender Gap Report of 2020, women in low and middle income countries are 8% less likely than men to own a mobile phone, which translates into 165 million fewer women than men owning a mobile. The gender gap further widens when it comes to ownership of smartphones, where women are 20% less likely than men to own a smartphone. As a result, women are also 20% less likely than men to use the internet on a mobile phone.

The report stated that while most barriers to mobile ownerships were common between men and women, women also faced the additional barrier of family disapproval. Further, in the case of ownership of smartphones, women were less likely than men to own their own devices stemming from their lack of financial autonomy.

The barriers to financial inclusion faced by women differ from and are more pronounced than those faced by their male counterparts. It is thus imperative to recognise these differences in order to achieve gender parity. Apart from increasing account ownership and digitalisingfinancial services, improving women’s capabilities to effectively use these services for their personal development through higher educational attainment, employment with fair wages, reduced unpaid care work and land reform measures among others is also necessary. It is only through the elimination of these structural constraints can the proposed financial inclusion measures be effectively implemented and women can be economically and socially empowered.

Written by- Yashaswi Shetty

Edited by- Jasmine Kaur Bhatia

The post Financial Inclusion: Through a Gendered Lens appeared first on The Economic Transcript.